Navigating Tax Obligations In Colombia: A Comprehensive Guide To The 2026 Tax Calendar

Navigating Tax Obligations in Colombia: A Comprehensive Guide to the 2026 Tax Calendar

Related Articles: Navigating Tax Obligations in Colombia: A Comprehensive Guide to the 2026 Tax Calendar

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating Tax Obligations in Colombia: A Comprehensive Guide to the 2026 Tax Calendar. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Tax Obligations in Colombia: A Comprehensive Guide to the 2026 Tax Calendar

The Colombian tax system, overseen by the Dirección de Impuestos y Aduanas Nacionales (DIAN), operates on a calendar-based system, outlining specific deadlines for various tax obligations. This system, known as the "Calendario Tributario," is crucial for businesses and individuals alike, ensuring timely compliance and avoiding potential penalties.

The 2026 Tax Calendar will provide a detailed roadmap for tax-related activities throughout the year, helping taxpayers stay organized and informed. It will encompass a wide range of tax obligations, including:

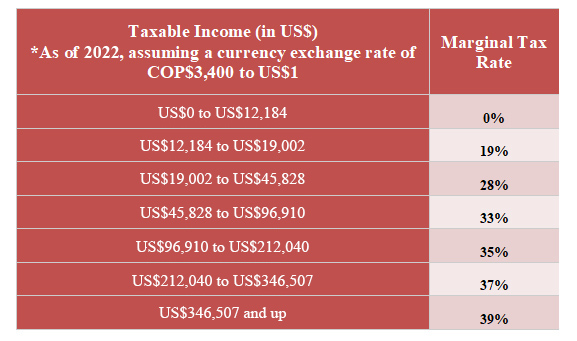

- Income Tax: This includes both personal and corporate income taxes, which are levied on earnings from various sources, such as salaries, business profits, and investments.

- Value Added Tax (VAT): VAT, a consumption tax, is levied on the sale of goods and services at different stages of the production and distribution process.

- Property Tax: This tax is levied on the ownership of real estate, including land, buildings, and other structures.

- Withholding Tax: This tax is deducted from payments made to individuals and businesses for services rendered or goods supplied.

- Excise Taxes: These taxes are levied on specific goods, such as alcohol, tobacco, and fuel.

- Other Taxes: The tax calendar will also include deadlines for other taxes, such as stamp taxes, registration taxes, and environmental taxes.

Understanding the Importance of the Tax Calendar

The 2026 Tax Calendar plays a vital role in facilitating smooth tax administration and ensuring compliance. Its significance lies in the following aspects:

- Organized Tax Planning: The calendar serves as a comprehensive guide, allowing taxpayers to plan their tax obligations in advance, ensuring timely payments and avoiding late penalties.

- Clear Deadlines: The calendar clearly defines the deadlines for various tax-related activities, reducing confusion and minimizing the risk of missing crucial filing dates.

- Efficient Tax Management: By adhering to the calendar, taxpayers can manage their tax obligations efficiently, avoiding last-minute rush and potential errors.

- Reduced Penalties: Timely compliance with tax obligations as outlined in the calendar helps minimize the risk of incurring penalties for late payments or non-compliance.

- Transparency and Accountability: The public availability of the tax calendar promotes transparency and accountability, fostering trust between taxpayers and the DIAN.

Navigating the 2026 Tax Calendar: Essential Tips

While the 2026 Tax Calendar will be released closer to the year’s commencement, following these tips can help individuals and businesses prepare for their tax obligations:

- Stay Updated: Regularly check the DIAN website and official communication channels for the latest updates and announcements regarding the tax calendar.

- Consult with a Tax Professional: Seek guidance from a qualified tax professional to ensure accurate understanding and compliance with all relevant tax regulations.

- Maintain Proper Records: Keep meticulous records of all financial transactions, invoices, receipts, and other relevant documents to support tax filings.

- Plan Ahead: Utilize the tax calendar to plan for upcoming tax obligations, ensuring sufficient time for preparation and timely filing.

- Utilize Available Resources: Leverage online resources, tax guides, and workshops provided by the DIAN to enhance your understanding of tax obligations.

Frequently Asked Questions (FAQs) about the 2026 Tax Calendar

Q1: When will the 2026 Tax Calendar be released?

A1: The DIAN typically publishes the tax calendar for the upcoming year in the latter months of the preceding year. It is advisable to check the DIAN website for official announcements and updates.

Q2: Where can I access the 2026 Tax Calendar?

A2: The 2026 Tax Calendar will be available on the official DIAN website, along with other relevant tax information and resources.

Q3: What happens if I miss a tax deadline?

A3: Missing a tax deadline can result in penalties, including fines and interest charges. It is crucial to adhere to the deadlines outlined in the tax calendar to avoid potential financial repercussions.

Q4: Are there any changes expected in the 2026 Tax Calendar?

A4: The DIAN may introduce changes to the tax calendar based on legislative updates, policy adjustments, or other relevant factors. It is essential to stay updated on any modifications or announcements made by the DIAN.

Q5: How can I get assistance with understanding my tax obligations?

A5: The DIAN offers various resources, including online guides, contact centers, and physical offices, to provide assistance and guidance to taxpayers. You can also consult with a qualified tax professional for personalized advice.

Conclusion: Embracing a Proactive Approach to Tax Compliance

The 2026 Tax Calendar will serve as a crucial tool for businesses and individuals navigating the Colombian tax landscape. By staying informed, planning ahead, and adhering to the deadlines outlined in the calendar, taxpayers can ensure smooth compliance, minimize potential penalties, and contribute effectively to the nation’s economic growth. A proactive approach to tax obligations fosters a culture of transparency, accountability, and responsible citizenship, contributing to a thriving and sustainable economic environment in Colombia.

![Filing Personal Taxes in Colombia: A Comprehensive Guide [UPDATED 2023] - LANGON COLOMBIA](https://langoncolombia.com/wp-content/uploads/2023/07/tabla_8-1-369x1024.png)

Closure

Thus, we hope this article has provided valuable insights into Navigating Tax Obligations in Colombia: A Comprehensive Guide to the 2026 Tax Calendar. We hope you find this article informative and beneficial. See you in our next article!

Leave a Reply