Navigating The 2026 Payroll Calendar For Queensland Public Servants: A Comprehensive Guide

Navigating the 2026 Payroll Calendar for Queensland Public Servants: A Comprehensive Guide

Related Articles: Navigating the 2026 Payroll Calendar for Queensland Public Servants: A Comprehensive Guide

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the 2026 Payroll Calendar for Queensland Public Servants: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the 2026 Payroll Calendar for Queensland Public Servants: A Comprehensive Guide

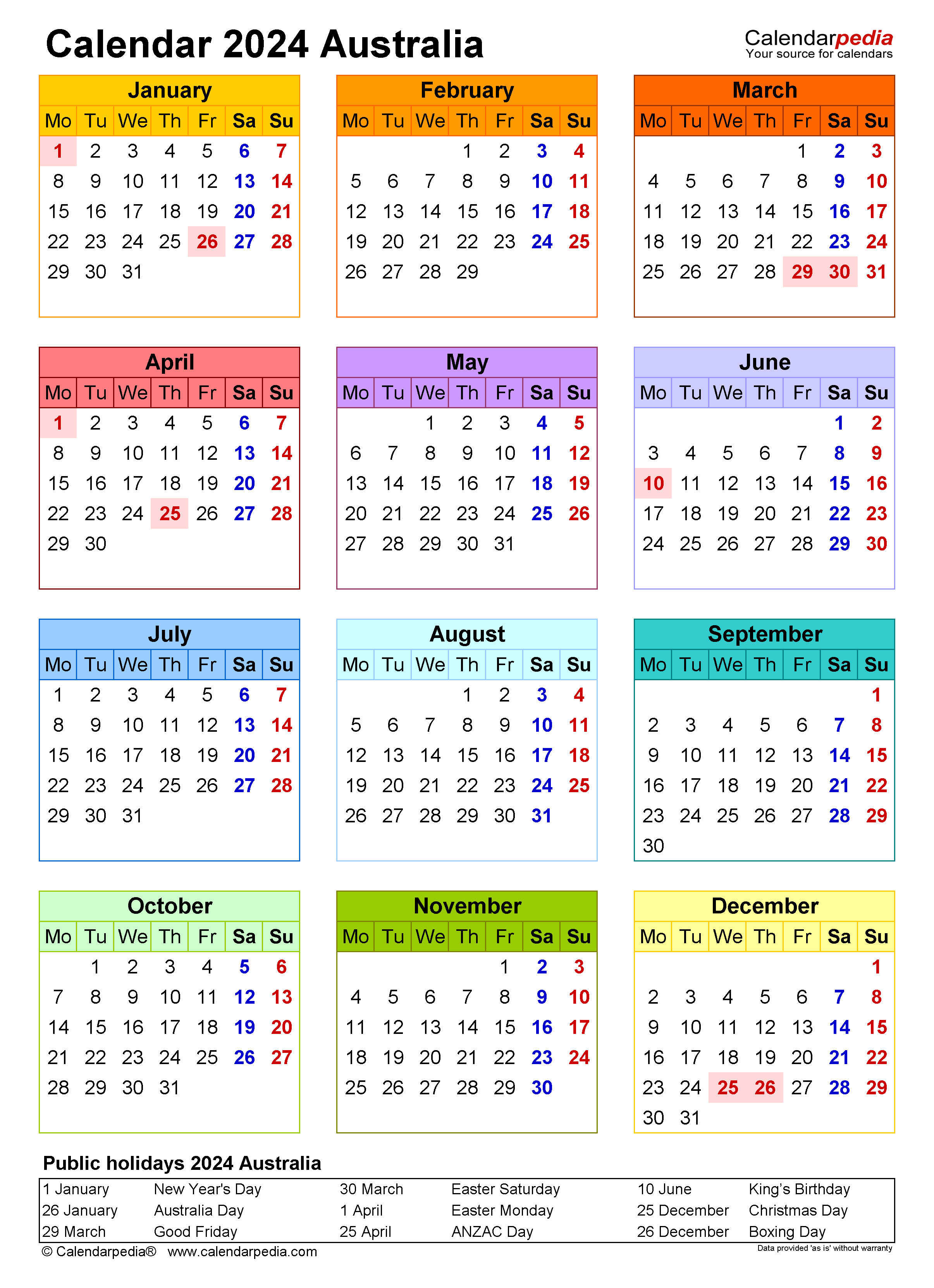

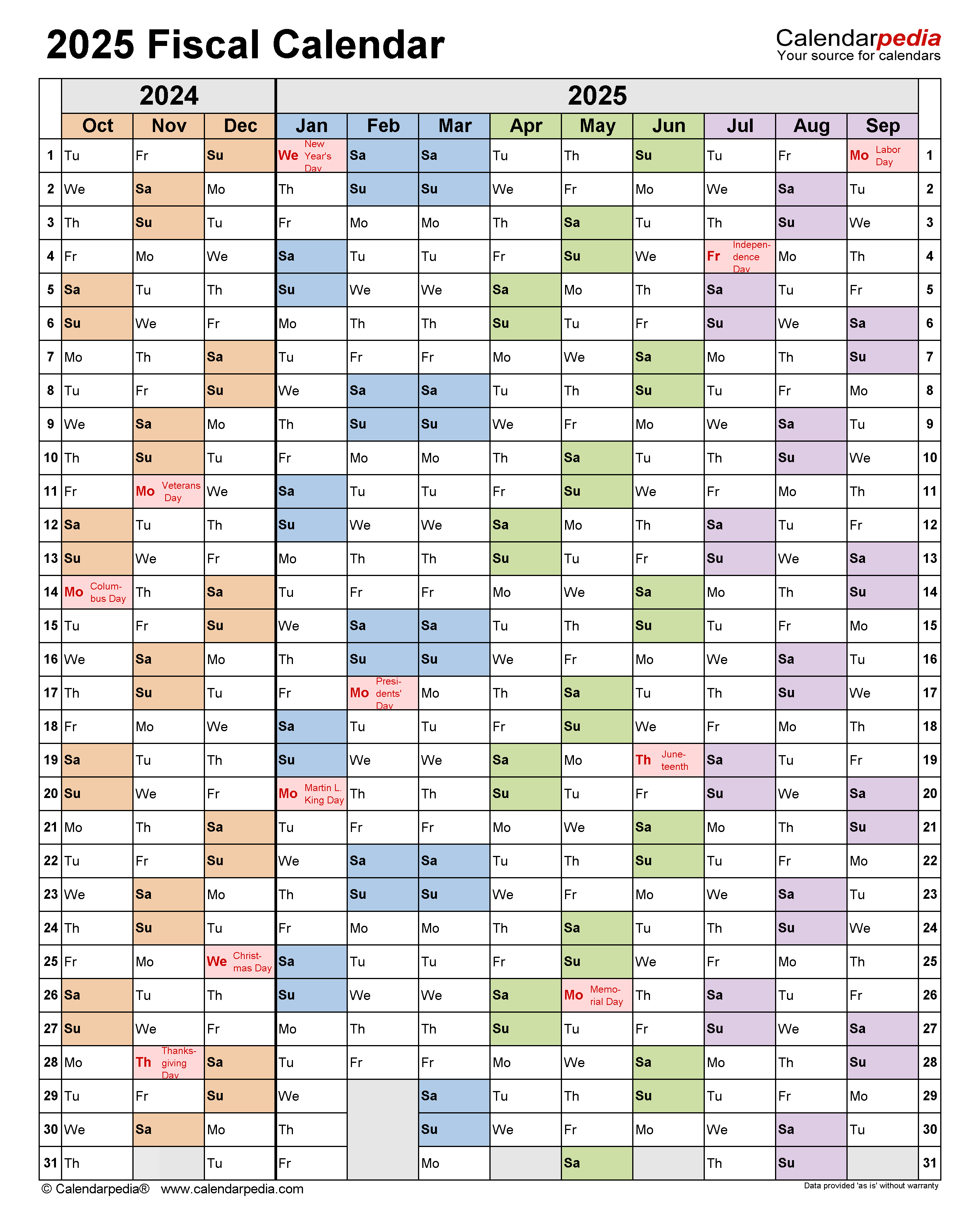

The Queensland Public Service (QPS) operates under a meticulously designed payroll calendar, ensuring timely and accurate payment for its dedicated workforce. This calendar provides a framework for salary disbursement, holiday periods, and other financial considerations. While the exact 2026 calendar is subject to annual adjustments, understanding the principles and key elements of the payroll system allows public servants to anticipate their paydays, plan for leave, and manage their finances effectively.

Understanding the Fundamentals:

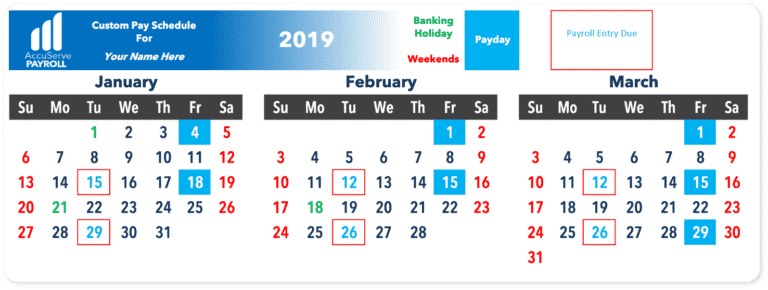

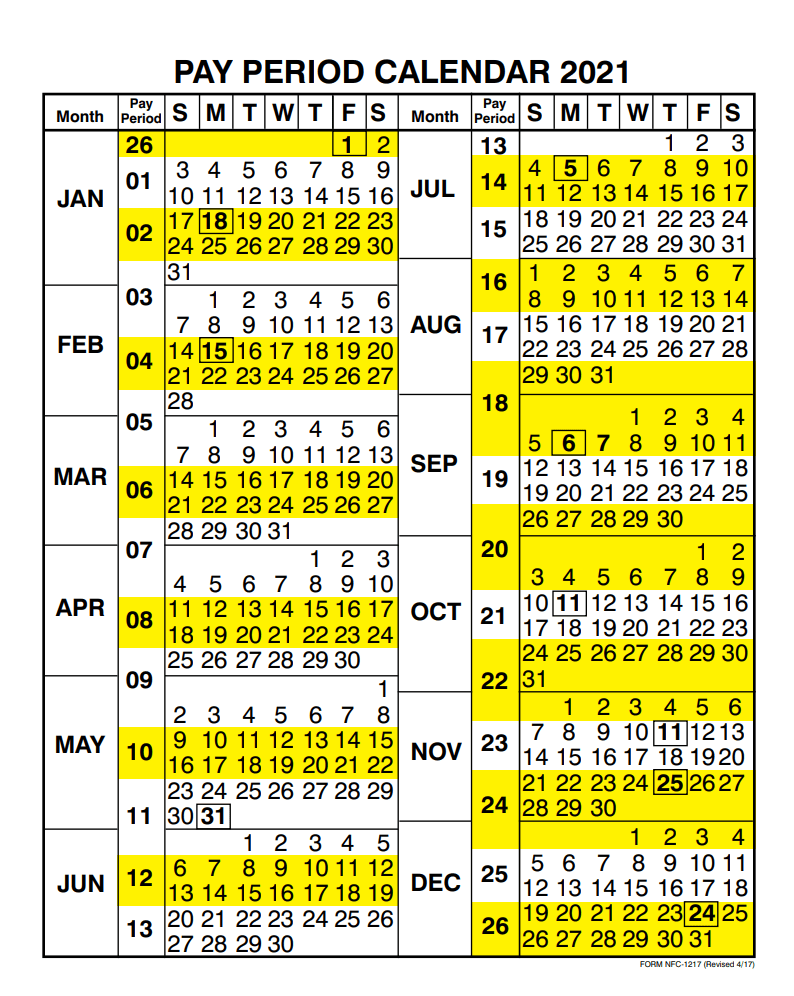

The QPS payroll calendar is based on a fortnightly payment cycle, meaning that public servants receive their salaries twice a month. These paydays are typically fixed, occurring on specific days of the week, regardless of public holidays or other calendar variations.

Key Elements of the Payroll Calendar:

-

Pay Dates: The QPS payroll calendar lists the specific dates on which salaries are processed and credited to employee accounts. This provides a clear timeline for financial planning, allowing public servants to budget and anticipate income flow.

-

Public Holidays: Public holidays are incorporated into the payroll calendar, ensuring that employees receive appropriate compensation for days they are not required to work. The calendar specifies whether a public holiday falls on a working day, resulting in a paid day off, or on a non-working day, in which case no additional payment is provided.

-

Leave Periods: The calendar outlines the designated leave periods throughout the year, including annual leave, sick leave, and long service leave. These periods allow public servants to plan their time off, ensuring adequate coverage for their roles while they are away.

-

Payroll Processing Deadlines: The calendar outlines the deadlines for submitting payroll information, such as timesheet entries and leave requests. This ensures that payroll processes are completed efficiently and accurately, minimizing delays in salary disbursement.

Benefits of a Structured Payroll Calendar:

- Financial Planning: The calendar provides a clear framework for budgeting and financial planning, allowing public servants to anticipate their income and manage their finances effectively.

- Time Management: Knowing the pay dates and leave periods allows public servants to plan their time off and manage their work commitments efficiently.

- Transparency and Accountability: The structured calendar promotes transparency in the payroll system, ensuring that employees understand the process and can hold the relevant authorities accountable for timely and accurate payments.

- Reduced Errors: The calendar helps to streamline payroll processes, reducing the potential for errors and ensuring that employees receive the correct compensation.

Navigating the Calendar:

The QPS payroll calendar is typically published annually and is available on the relevant government website. It is essential for public servants to familiarize themselves with the calendar and its key elements to ensure they understand their paydates, leave entitlements, and other financial considerations.

FAQs:

Q: What happens if a public holiday falls on a payday?

A: In this scenario, the payday will typically be shifted to the next working day. The calendar will clearly indicate any such adjustments.

Q: Can I access my payslips online?

A: Yes, most public service organizations provide online access to payslips through dedicated employee portals.

Q: How can I request leave?

A: Leave requests must be submitted according to the procedures outlined by your department, typically through an online system or by completing a physical form.

Q: What are the deadlines for submitting payroll information?

A: The deadlines for submitting timesheets and other payroll information are specified in the payroll calendar. It is crucial to adhere to these deadlines to ensure timely payment.

Tips for Effective Utilization:

- Save a copy of the calendar: Keep a copy of the payroll calendar readily accessible for reference throughout the year.

- Set reminders: Use calendar applications or other reminders to note important dates, such as paydays, leave periods, and payroll deadlines.

- Contact your HR department: If you have any questions or concerns regarding the payroll calendar or your pay, contact your department’s HR department for clarification.

Conclusion:

The 2026 payroll calendar for Queensland public servants is a vital tool for financial planning, time management, and ensuring timely and accurate payment. By understanding the key elements of the calendar and utilizing it effectively, public servants can optimize their financial well-being and navigate the payroll system with confidence.

Closure

Thus, we hope this article has provided valuable insights into Navigating the 2026 Payroll Calendar for Queensland Public Servants: A Comprehensive Guide. We appreciate your attention to our article. See you in our next article!

Leave a Reply