Navigating The July Fiscal Year 2026 Calendar: A Comprehensive Guide

Navigating the July Fiscal Year 2026 Calendar: A Comprehensive Guide

Related Articles: Navigating the July Fiscal Year 2026 Calendar: A Comprehensive Guide

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the July Fiscal Year 2026 Calendar: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the July Fiscal Year 2026 Calendar: A Comprehensive Guide

The concept of a fiscal year, distinct from the conventional calendar year, is employed by numerous organizations, governments, and businesses worldwide. A fiscal year (FY) typically encompasses a 12-month period that may commence at a point other than January 1st. The July fiscal year, with its commencement on July 1st, presents a unique framework for financial planning, budgeting, and reporting. This article delves into the intricacies of the July FY 2026 calendar, exploring its significance, benefits, and practical implications for various stakeholders.

Understanding the July Fiscal Year 2026 Calendar

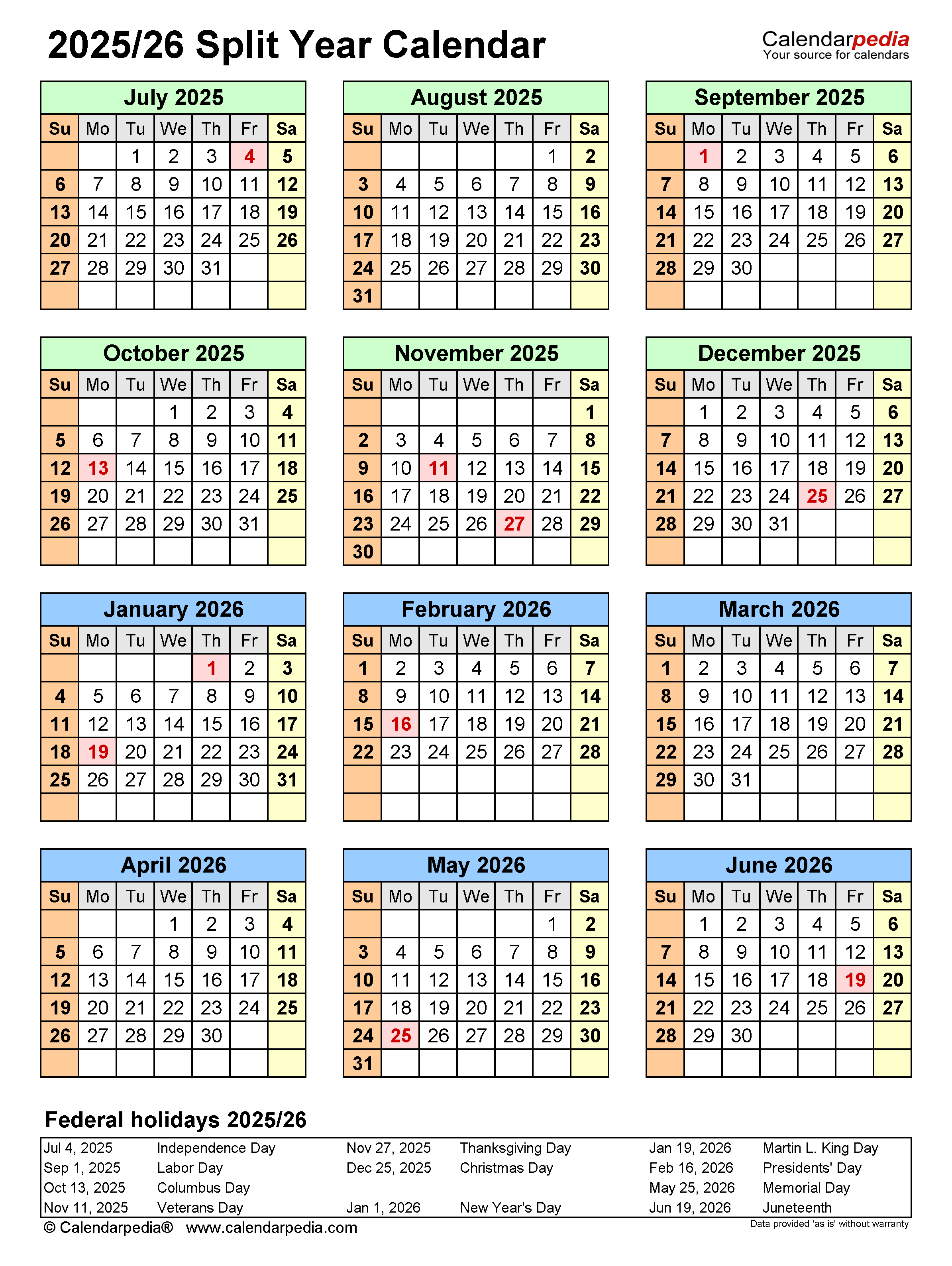

The July FY 2026 calendar designates July 1st, 2025, as the start of the fiscal year, concluding on June 30th, 2026. This calendar structure aligns with the financial reporting and budgeting cycles of numerous entities, particularly in nations like Australia, India, and several African countries. The adoption of a July FY often stems from historical, climatic, or economic factors specific to the region.

Benefits of a July Fiscal Year

The utilization of a July FY offers several advantages, including:

- Alignment with Seasonal Cycles: For nations with distinct agricultural seasons, a July FY can better synchronize financial reporting with crop cycles and revenue generation. This is particularly relevant for agricultural economies where income is heavily dependent on harvest periods.

- Enhanced Financial Planning: The July FY enables organizations to initiate their budgeting and financial planning processes during the post-harvest season, providing a more accurate assessment of the previous year’s performance and setting realistic targets for the upcoming fiscal year.

- Improved Budgetary Control: The July FY allows for a more comprehensive assessment of financial performance before the start of the new fiscal year. This facilitates better resource allocation, expenditure control, and the identification of potential financial challenges.

- Streamlined Reporting: A July FY can simplify the process of financial reporting, as it aligns with the annual reporting cycle of many organizations and financial institutions.

Navigating the July FY 2026 Calendar: Practical Considerations

For organizations operating under a July FY, several practical considerations are crucial:

- Financial Planning: Budgeting and financial forecasting should be initiated well in advance of the start of the fiscal year, taking into account potential economic fluctuations, market trends, and internal operational factors.

- Tax Compliance: Organizations must adhere to the tax regulations and deadlines specific to their jurisdiction, ensuring timely payment of taxes and submission of tax returns.

- Reporting and Audits: Financial reporting and auditing processes should be meticulously planned and executed to ensure compliance with regulatory requirements and the timely dissemination of financial information.

- Employee Compensation and Benefits: Compensation cycles and benefit programs should be aligned with the July FY to ensure consistency and clarity for employees.

FAQs Regarding the July Fiscal Year 2026 Calendar

Q: What are the key dates within the July FY 2026 calendar?

A: Key dates within the July FY 2026 calendar include:

- July 1st, 2025: Commencement of the fiscal year.

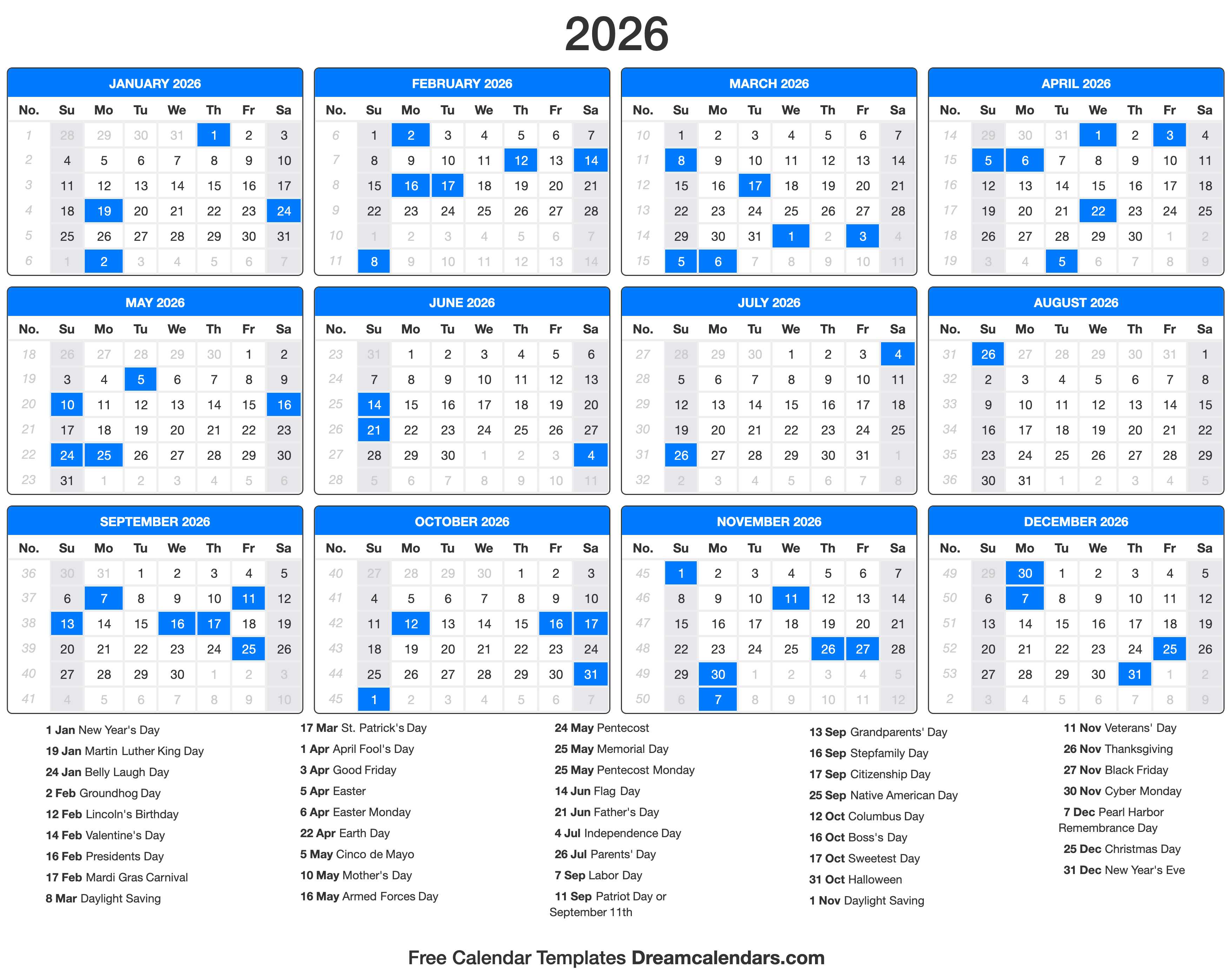

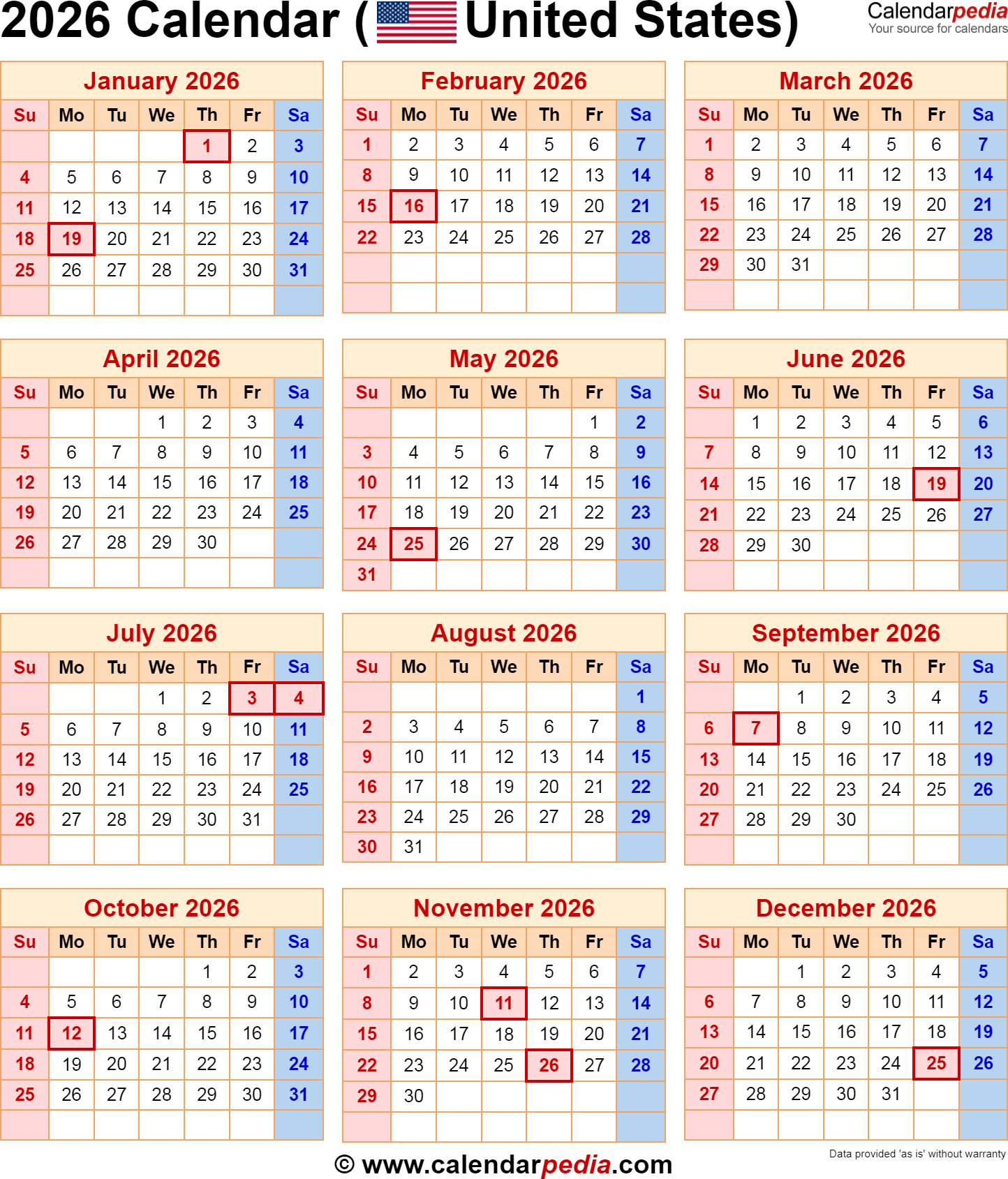

- June 30th, 2026: Conclusion of the fiscal year.

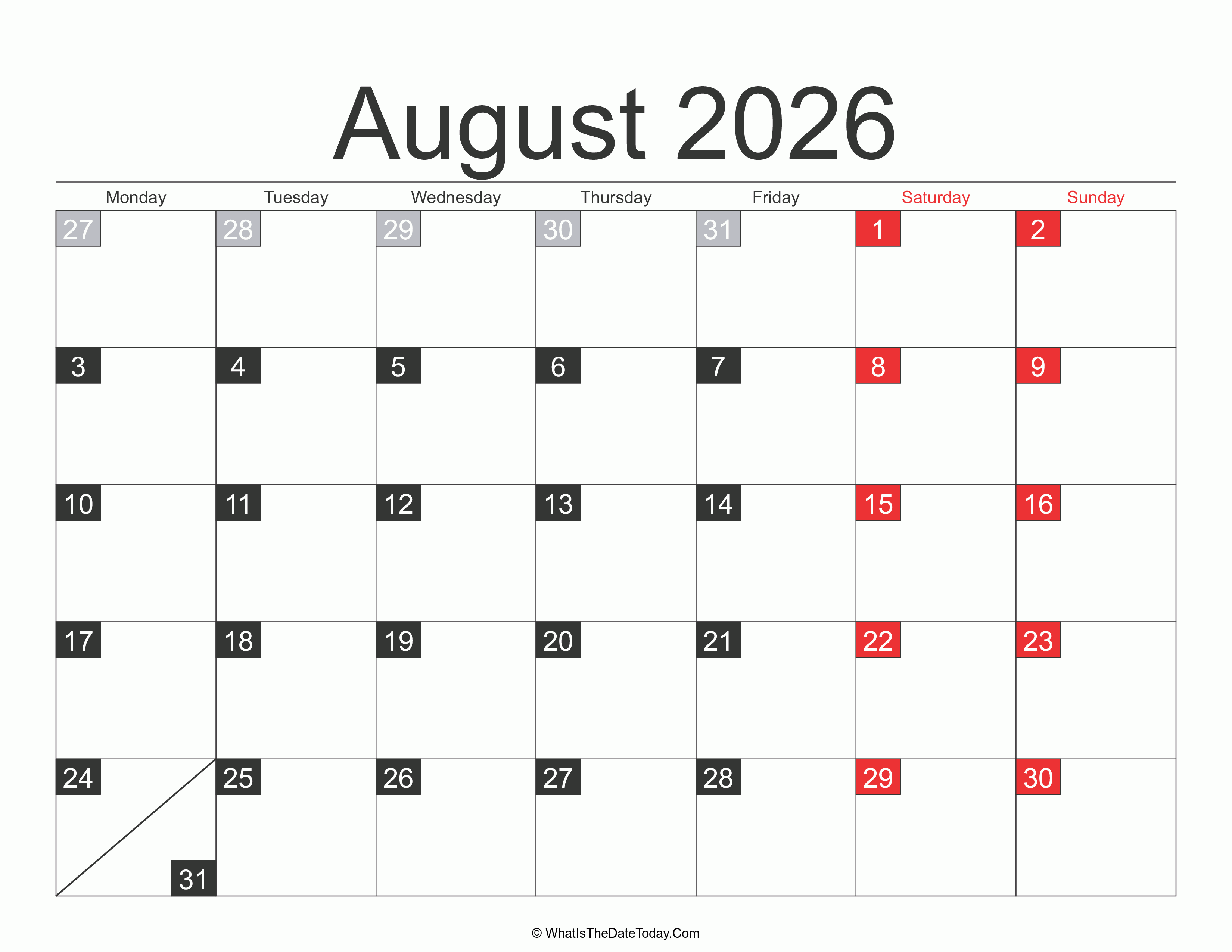

- Quarterly deadlines: Organizations typically have quarterly reporting deadlines for financial performance, which would fall on September 30th, December 31st, March 31st, and June 30th.

- Tax Filing Deadlines: Tax filing deadlines are specific to each jurisdiction and should be consulted for accurate information.

Q: How does a July FY impact financial reporting?

A: A July FY typically leads to a shift in the financial reporting cycle, with reporting periods commencing on July 1st and ending on June 30th. Organizations must adjust their reporting processes to align with this fiscal year structure.

Q: What are the implications of a July FY for businesses?

A: Businesses operating under a July FY must adapt their financial planning, budgeting, and reporting processes to align with the fiscal year structure. This may involve adjustments to inventory management, revenue recognition, and expense reporting.

Q: Are there any specific challenges associated with a July FY?

A: Challenges associated with a July FY may include:

- Coordination with global partners: Organizations with international partners operating on different fiscal years may face challenges in coordinating financial information and reporting.

- Data analysis and reporting: The shift in fiscal year structure may require adjustments to data analysis and reporting systems to accommodate the new fiscal year dates.

- Employee compensation and benefits: The July FY may necessitate adjustments to employee compensation and benefits programs to align with the new fiscal year structure.

Tips for Managing a July Fiscal Year

- Early Planning: Initiate financial planning and budgeting processes well in advance of the start of the fiscal year to ensure adequate time for thorough analysis and decision-making.

- Effective Communication: Maintain clear and consistent communication with stakeholders, including employees, investors, and regulatory bodies, regarding the fiscal year structure and its implications.

- Technology Adoption: Utilize financial software and technology tools to streamline financial processes, automate reporting, and enhance data analysis capabilities.

- Compliance Awareness: Stay informed about relevant tax regulations, reporting requirements, and other legal obligations applicable to the July FY.

Conclusion

The July fiscal year calendar offers a distinct framework for financial management, providing unique benefits and challenges for organizations and individuals operating within its structure. By understanding its nuances, embracing its advantages, and proactively addressing its potential challenges, stakeholders can effectively navigate the July FY 2026 calendar and achieve their financial objectives. Effective planning, communication, and technological adoption are crucial for maximizing the benefits of a July FY and ensuring smooth financial operations.

Closure

Thus, we hope this article has provided valuable insights into Navigating the July Fiscal Year 2026 Calendar: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!

Leave a Reply